Ledger - TRADELINK

Introduction - Ledger Enterprise TRADELINK

Reducing Counterparty Risk with Ledger Enterprise TRADELINK

The cryptocurrency industry is changing its focus as it reaches maturity. Prior to FTX collapse, the industry was focused solely on transaction speed and connectivity to third-party services such as exchanges and liquidity providers. However, after FTX, the market is moving towards minimizing and distributing counterparty risk.

As a result, crypto custody technology providers having a single lock-in network framework are scrambling to provide an alternative to minimize counterparty risk. However, not all solutions are created equal.

Historically, exchanges held most of the client trading collateral, which caused concentration of risk within few entities. In an attempt to mitigate this risk custody vendors have attempted to bootstrap off-exchange solutions which effectively shifts the risk from the exchange to the network operator and lock-in clients into a single framework.

The solution to minimize counterparty risk is an open governance framework that allows customisation of rules regulating the relationship within network participants. A shared network where governance which is open and transparent.

Ledger offers a multi-custody governance model with a clear definition of ownership. It provides enterprise-grade self-custody while managing your own digital assets or working with one or more external custodians. All of this is done with a transparent, auditable and flexible funds management policies.

TRADELINK's Tech-Only, Security-First Approach

We take a tech-only, security-first approach. Our focus is on technology, and we will never compete with our financial services clients. Our platform is open, with no network lock-in, and we are not a counterparty. At Ledger, our mission is to offer self-custody solution with access to external services build around minimization of counterparty risk. The following product is designed to help institutions meet their regulatory requirements while maintaining the highest level of security for their assets.

About this document

This document provides a guide on how to integrate with TRADELINK; a secure and transparent pledging solution, which allows you to maintain custodial ownership of your assets by pledging collateral for trading. You can work with Ledger's extensive global network of custodians and exchanges or build your own network of trusted counterparties.

Integrating with Ledger Enterprise TRADELINK

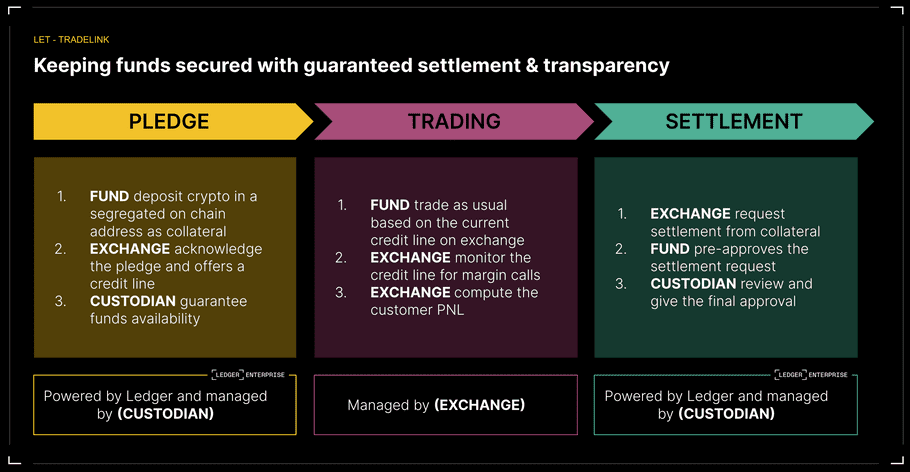

In TRADELINK, there are three main roles related to collateral management: the FUND, the EXCHANGE, and the collateral agent. These role definitions are aligned with collateral management roles in traditional finance.

- Funds : This party is responsible to pledge assets as collateral. In the case of TRADELINK, we refer as FUND for Institutional Investor: Asset Managers, Funds, etc.

- Custodian : This party is responsible for managing custody and approval of transfer of collateral. In the case of TRADELINK, the CUSTODIAN can be either a fund, prime broker, exchange yet it generally a custodian.

- Exchange : This party is responsible to monitor variation margin and sufficiency of collateral, providing service and trading facility. In the case of TRADELINK, the EXCHANGE could be an exchange, OTC desk, a market maker, or a prime broker. The EXCHANGE can use pledged collateral to settle trades.

💡 Disclaimer

Please be advised that the roles mentioned in this document are not intended to provide legal or financial advice. The actual setup of this solution is determined by the parties involved and does not involve Ledger.

Network Setup

TRADELINK is a flexible framework that allows network participants to create customized governance based on their own unique circumstances.

To begin the process of joining the network, Ledger begins by scheduling a kick-off workshop involving parties that will be part of your unique governance framework, including at least one FUND and one EXCHANGE and generally a third party like a CUSTODIAN.

By the end of this workshop, the unique governance framework should be defined and Ledger will begin the setup of a live sandbox environment mirroring the agreed governance framework. In the next product increment, the creation of governance rules based on the network you are joining will be automatic and directly performed in Ledger Enterprise UI.

Overview

The Ledger Enterprise API allows any authorized participant (EXCHANGES or FUNDS) to pledge and monitor collateral held by the CUSTODIAN. You can receive real-time notifications for any update on collateral balance, and pledging of assets is performed by a FUNDr. The same APIs allow a CUSTODIAN and EXCHANGE to agree on the last state of trading positions/settlement instructions and approval of settlement transactions. You can also choose to involve the FUND as a approver of the settlement.

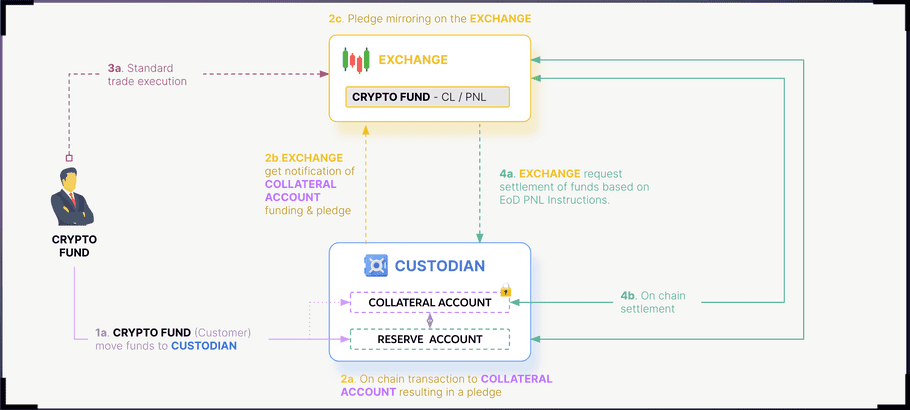

In the following diagram, you have an overview of the flow of funds for the trading network.

Integration paths

Based on your role on the network you will need to follow a different guide to connect to the network.

Instructions for EXCHANGES

- Full-Pledge Mirroring and Settlement is the version currently implemented by the network participants.

- Multi-Pledge Mirroring and Settlement is the next product increment with better manager of the pledge and addressing the first feedback we got from the full pledge. This link will be available later this year.